At ADP TotalSource®, we work hard to keep the lines of communication open to make sure you have accurate and up-to-date management reports. Ensuring data accuracy is a joint effort, which is why your help is needed.

At the beginning of each calendar year, ADP TotalSource scans all of your Employee Masterfiles and removes, or purges, unnecessary employee records. Normally, an employee record is “Set for Purge” if that employee meets one of the following criteria for the previous calendar year:

1. Employee has been set to a terminated status

2. Employee is on active status, but has not received any earnings or compensation since November 14, 2014

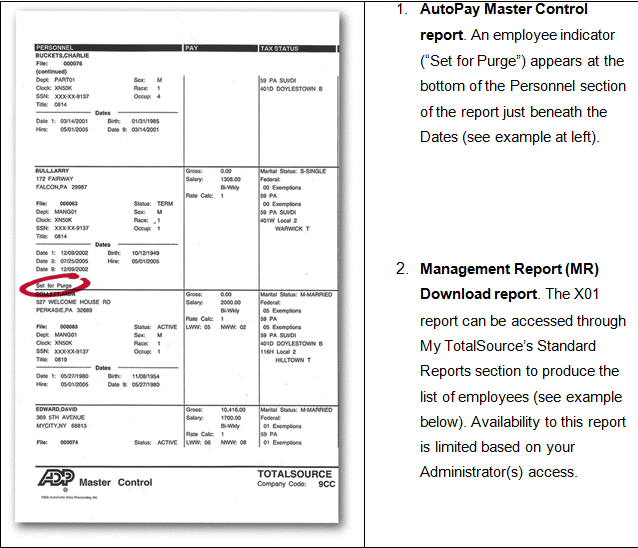

There are two options for determining which employees have met the above criteria and are “Set for Purge.”

Both of these reports are available once the first payroll of January 2015 is processed. Please review your current AutoPay Master Control report and identify the employees who have the “Set for Purge” indicator – or have your Administrator access the MR Download report. If an employee is flagged and you do not want them removed from your AutoPay masterfile data, please follow these simple steps:

- Compile a list of employee names in question

- Contact your Payroll Service Representative to discuss if it is appropriate to keep the employee(s) on your payroll masterfile

- Please make your request(s) by February 13, 2015

It is important to note that employees who are allowed to purge will not receive Benefits Enrollment Kits during the upcoming Open Enrollment period beginning in March.

Thank you for your help!