2018 ACA Tax Filing – Final Steps

03/07/19

Author: ADP Admin/Tuesday, March 5, 2019/Categories: Federal Compliance Update

2018 ACA Tax Filing – Final Steps

One Milestone Down, One to Go.

Forms 1095-C should have been approved and furnished to your employees by the IRS Deadline for furnishing the forms to your employees. Our next step is to ensure the IRS receives your Forms 1094-C and 1095-C transmission by the IRS’ April 1st deadline.

If you haven’t already, you should review and approve your Form(s) 1094-C in ADP Health Compliance. After approving your Forms 1094-C and 1095-C, you can track the transmission status of your Forms 1094-C and1095-C to the IRS.

Please note that ADP TotalSource will automatically approve all un-approved Forms 1094-C on March 14th to ensure timely transmission to the IRS.

- After approval, the transmission status will be viewable and updated frequently in ADP Health Compliance.

- Typically, within 7 business days the IRS evaluates the transmission and then sends an acknowledgement.

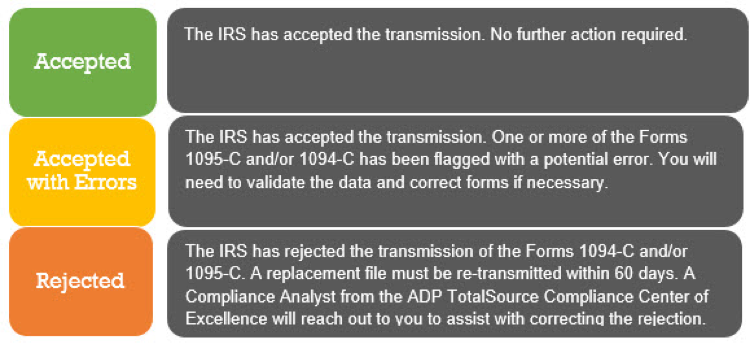

IRS Response Types

Accepted with Errors: Validating the Data

The most common condition that results in an “Accepted with Errors” transmission receipt is a Social Security Number/Name mismatch for one or more of your employees and/or a dependent listed in Part III of the Form 1095-C (self-funded clients only).

Common reasons for mismatch errors include:

- An incomplete name or nickname was provided by the employee at time of hire.

- The employee changed his or her name (i.e., due to marriage, divorce) but has not yet notified the Social Security Administration or the IRS.

- Digits were transposed at the time the Social Security Number was provided or entered into the payroll system.

Action Required:

The IRS requires that employers undertake a “good faith effort” to promptly correct mismatch errors. Please follow the steps below to help correct the mismatch error(s). Click here for detailed instructions on viewing and correcting errors.

- Review Errors:

To review the forms rejected by the IRS list on ADP TotalSource, go to Process > ACA > ACA Health Compliance and click on the Needs Attention box. Note - the IRS does not require a “good faith effort” to correct mismatch errors for terminated employees.

- Making Corrections:

Click on individual forms and review the error of form(s). If a correction is found, edit the form and save and submit the corrected form. Please Note: The IRS can take up the 7 days to confirm if a correction was accepted.

If a correction is not found, the next step is to reach out to your employee and advise them of the error. Your employee may need to contact the Social Security Office to resolve the issue. Employees may log on to www.ssa.gov or call 1-800-772-1213 to find the nearest office. Once resolved, please update our system with the corrected information and submit the corrected Form 1095-C following the steps above.

ADP TotalSource has created an FAQ document and sample letter to assist you and your employees. If you have any questions, please contact your Human Resource Business Partner. If employees have questions, please direct them to the MyLife Advisor Center at 1-800-448-0325 or via email at MyLifeAdvisor@adp.com.

Number of views (13625)/Comments (0)